Compare an options trade to the underlying stock purchase

Posted Oct 20 2020

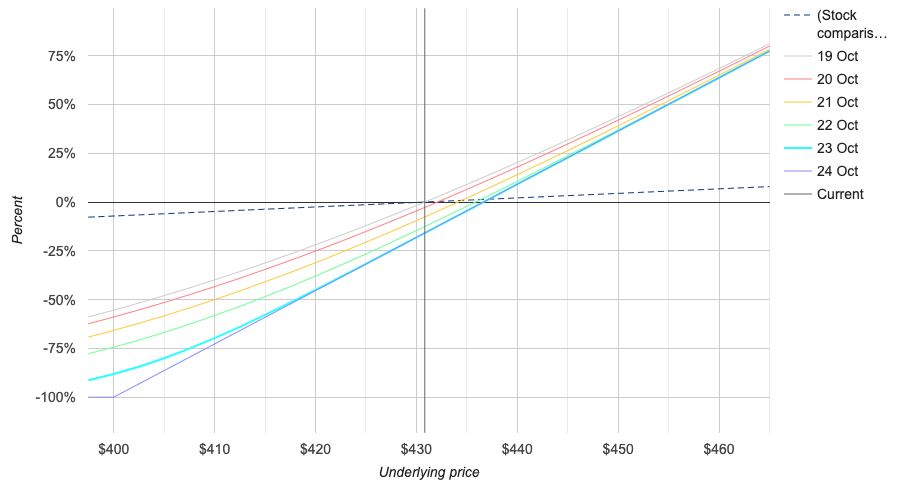

Line Chart results now have an additional dashed line showing the comparative profit or loss of buying the underlying stock outright.

The comparison stock purchase is based on the cost to open the trade, so if your options trade would cost $120 to open, the stock comparison line will reflect the profit or loss of purchasing $120 worth of stock.

Note that if the cost to open the options trade is less than the price of a single underlying share in the stock, the comparison will be representative of a fractional amount of the share. This allows you to compare the trade’s dollar-for-dollar performance, even if your broker does not offer fractional shares of that particular stock.

(The stock comparison line does not display for naked options, or spreads which result in an opening credit.)